虚拟货币期权合约

2023年05月10日 15:35

欧易okx交易所下载

欧易交易所又称欧易OKX,是世界领先的数字资产交易所,主要面向全球用户提供比特币、莱特币、以太币等数字资产的现货和衍生品交易服务,通过使用区块链技术为全球交易者提供高级金融服务。

请订阅并关注我的B站/油管(灰岩金融科技)并收听我的各种市场观点!

Quanto中文一般称为“双币期权”或是中大西洋选择权(中大西洋期权)宽他选择权(Quanto宽他期权)。

Quanto是Quantity Adjusting Option的简称,是指标的物(underlying)是以货币A计价,但是以货币B来结算的现金交割型衍生性金融商品。

百慕达选择权(百慕大选择权)又称为准美式选择权(准美国选择权)或中大西洋选择权(中大西洋选项)。它是一种介于欧式和美式之间的选择权。百慕达选择权在到期日之前有几个固定日期,买方可以提早,以某些固定价格换取标的资产。

若要再细分的话,事实上在美式及欧式选择权之间,还有第三类的选择权。那就是大西洋式选择权(AtlanticOptions)。

或百慕达式选择权(BermudianOptions)

从字面上,读者可以很轻易地看出来,这种选择权的履约条款介于美式和欧式之间(大西洋和百慕达地理位置都在美欧大陆之间)。例如,某个选择权契约,到期日在一年后,但在每一季的最后一个星期可以提前履约(可在到期日期履约,但可履约日期仍有其他限制),这就是最典型的百慕达式选择权。

Quanto 产品的价值是牵涉涉嫌一种货币,但产品的损益则使用另外一个货币结算。例如买卖日经225指数期货,便要牵涉两个风险──第1个就是指数升跌的风险;第2个就是日圆 升跌的风险。

如果采用美元投资日股,便要解决汇率风险问题,而Quanto就是这种能够解决汇率风险的产品。例如在美国商品期货市场(CME),就有日经225期货买卖,属于Quanto类型。虽然 指数的升跌是与日圆报价的日经成份股有关,但期货的结算却使用美元(文后会附上Nikkei Quanto 示例)。

FX strategies based on quanto contract information

基于双币合约信息的外汇策略

Quantos are derivatives that settle in currencies different from the denomination of the underlying contract. Therefore, quanto index contracts for the S&P 500 provide information on the premia that investors are willing to pay for a currency’s risk and hedge value with respect to U.S. stocks. Currencies that command high risk premia and provide little hedge value should have superior future returns. These premia can be directly inferred from quanto forward prices, without estimation. Empirical evidence supports the case for quanto contracts as a valid signal generator of FX strategies.

双币合约Quantos是以不同于基础合约面额的货币结算的衍生产品。

因此,S&P 500的量化指数合约提供了有关投资者愿意为该货币对美国股票承担的风险和对冲价值而支付的溢价的信息。要求高风险溢价且几乎没有套期保值价值的货币应具有较高的未来收益。这些溢价可以直接从量化远期价格中推断出来,而无需估算。经验证据支持量化合约作为外汇策略有效信号发生器的情况。

Kremens, Lukas and Ian Martin (2017), “The Quanto Theory of Exchange Rates”, May 2017.

The post ties in with this sites’ lecture on implicit subsidies.

The below are excerpts from the paper. Emphasis and cursive text have been added.

What is a quanto?

什么是双币合约?

A quanto is a derivative that settles in a currency that is different from the currency of the principal underlying instrument. For example, a quanto of the S&P 500 index can be a derivative that settles in euro. This means that the dollar value of the S&P 500 is translated into a corresponding amount in euros by using a fixed exchange rate. Hence, quantos depend both on primary asset prices and exchange rates. There are quanto futures contracts, swaps and options. The valuation of quanto derivatives depends on the expected joint distribution of the future exchange rate and future underlying contract price.

双币期权是一种衍生工具,其结算货币与主要基础工具的货币不同。例如,标准普尔500指数的量化指标可以是以欧元结算的衍生产品。这意味着,使用固定汇率可以将标准普尔500的美元价值转换为相应的欧元金额。因此,双币合约的定价取决于主要资产价格和汇率。

有双币期货合约,掉期和期权。双币衍生工具的估值取决于未来汇率和未来基础合约价格的预期联合分布。

“An investor who is bullish about the S&P 500 index might choose to go long a forward contract at time t, for settlement at time t + 1. If so, he commits to pay a fixed price at time t + 1 in exchange for the level of the index…A quanto forward contract is closely related. The key difference is that the quanto forward commits the investor to pay a fixed price in units of currency i at time t+1, in exchange for the level of the index in units of currency i [at that time]… The quanto forward and conventional forward prices are equal if and only if currency i is uncorrelated with the stock index under the risk-neutral measure. Moreover, the quanto risk premium term…is directly revealed by the gap between quanto and conventional index forward prices.”

“对标准普尔500指数看好的投资者可能选择在时间t做多远期合约,以便在时间t + 1结算。如果这样,他承诺在时间t + 1付出固定价格,以换取指数水平。双币远期合约密切相关。

主要区别在于,双币远期承诺使投资者在时间t + 1处以货币i为单位支付固定价格,以换取[i]当时以货币i为单位的指数水平。

当且仅当货币i与风险中性度量下的股票指数不相关时,常规远期价格才是相等的。此外,双币风险溢价期限将直接由量化与传统指数远期价格之间的差距所揭示。”

The Nikkei Quanto Future

日经双币期货合同

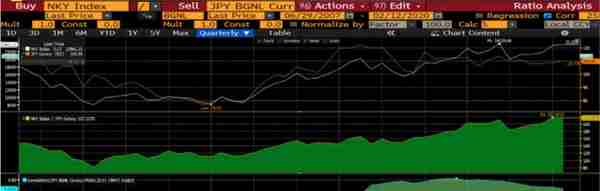

The most famous quanto derivative in traditional markets is the Nikkei 225 Index Future on the Chicago Mercantile Exchange. Nikkei 225 (NKY) is the most commonly traded equity index product on the Japanese stock market and its futures trade simultaneously across three exchanges: Osaka (OSE), Singapore (SGX), and Chicago (CME). In Osaka and Singapore they trade primarily in Japanese Yen margin while in Chicago they primarily trade in USD margin. The OSE multiplier is 1000 JPY, the SGX multiplier is 500 JPY, while the CME multiplier is 5 USD.

在传统市场上,最著名的量子衍生物是芝加哥商业交易所的日经225指数期货。日经225(NKY)是日本股票市场上最常交易的股票指数产品,其期货同时在大阪(OSE),新加坡(SGX)和芝加哥(CME)三个交易所交易。在大阪和新加坡,它们主要以日元保证金交易,而在芝加哥,它们主要以美元保证金交易。

OSE乘数为1000日元,SGX乘数为500日元,而CME乘数为5美元。

The correlation between USD/JPY and NKY is typically quite positive due to few macroeconomic reasons:

- JPY is a risk-off safe haven currency that gains when stocks fall.

- Japan exporters, and hence Japanese stocks, become more globally competitive as JPY weakens.

由于几个的宏观经济的因素影响,USD / JPY与NKY之间的相关性通常是非常正的:

1. 日元是避险避险货币,当股票下跌时会上涨。

2. 随着日元贬值,日本出口商以及日本股票在全球更具竞争力。

We see that the quanto future trades at a persistent premium to the JPY-based future. Why is this?

我们看到,双币期货合约的交易价格比基于日元的期货交易价格高。

为什么是这样?

The most intuitive way to understand this is to imagine you are simultaneously short the quanto and long the normal future. If the Nikkei market gaps up 50%, you will have losses on your quanto future and gains on your normal future. If USD/JPY is instantaneously up 25% as well, then it would mean that your quanto losses hurt much more than your normal future gains–and hence, you would require some premium from the market to undertake such a risk.

理解这一点的最直观的方法是想象您同时做空双币期权和做多期货合约。

如果日经市场缺口扩大了50%,您的双币期货将蒙受损失,而Nikkei合同则将受益。如果美元/日元也立即上涨25%,那么这意味着您的双币合约的损失比正常的未来收益所遭受的损失要大得多-因此,您需要从市场上收取一些溢价(权利金)才能承担此类风险。

Alternatively, one can imagine the converse: again you are short the quanto and long the normal future. USD/JPY goes up 25%; now the economic risk of your short quanto is much higher than the economic risk of your long normal because $5 per point is worth more in JPY than it was before. To rebalance your Nikkei delta, or risk, to be flat–you must buy more Nikkei futures. If the Nikkei itself jumped instantaneously, then you will end up buying at the high price. If USD/JPY then jumped back to what it was originally and so did the Nikkei, you’d have to sell back the deltas that you just bought–thereby negative scalping.

或者,您可以想象相反的情况:您又做空了双币合约,而做空Nikkei期货合同。美元/日元上涨25%;

现在,您做空短线的经济风险要比长期做多的经济风险高得多,因为每点5美元的日元价值比以前更高。为了使您的日经delta的风险被对冲以及再平衡,您必须购买更多日经期货。

如果日经指数本身突然跳升,那么您最终将以高价购买该合同。如果美元/日元随后又回到了原来的水平,日经指数也是如此,那么您就必须sell delta并且买入该合同。

This process of constantly negative scalping delta in an attempt to remain delta-neutral is not a bug but an intrinsic property of quanto risk.

这个通过不断减少delta卖出spot以维持头寸本身的delta中性的过程不是一个漏洞,而是双币期权风险的内在属性。

ETH Quanto

以太坊双币合同

Source: BambouClub

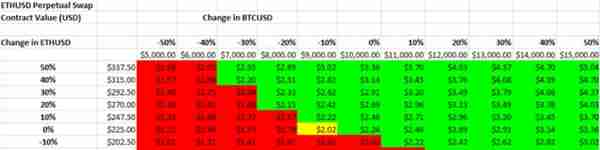

Coming back to the ETH quanto itself, we see that similar to the Nikkei example earlier, the value in USD declines substantially when BTC/USD itself declines–and vice versa. This is because the notional value of ETHUSD swap contracts depends on the BTC/USD price:

回到ETH双币合同本身,我们看到类似于之前的Nikkei示例,当BTC / USD本身下跌时,美元价值大幅下跌,反之亦然。

这是因为ETHUSD掉期合约的名义价值取决于BTC / USD价格:

When BTC goes up, the payout of the quanto itself goes up because the value of the multiplier goes up in USD. Hence, a short quanto position always carries tremendous risk to any trader given the very high realized correlations.

当BTC上涨时,由于乘数的价值以美元为单位,因此量子本身的支出也随之上升。因此,鉴于已实现的很高的相关性,空头部位总是给任何交易者带来巨大风险。

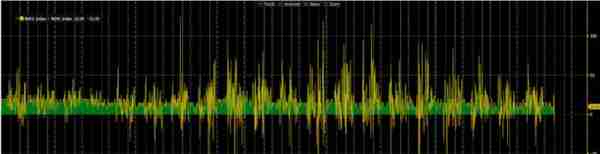

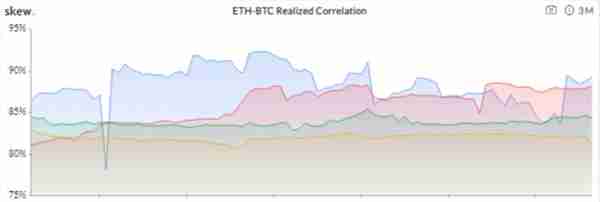

The correlation between ETH/USD and BTC/USD has been over 80% the past year and shows no signs of dissipating. Therefore, being short the quanto means having our losses magnified when prices go up and our wins minimized when prices go down.

过去一年,ETH / USD和BTC / USD之间的相关性已经超过80%,并且没有消失的迹象。

因此,做空双币合同交易意味着在价格上涨时我们的损失会放大,而在价格下跌时我们的获利会最小化。

How much might this be worth? The formula for the theoretical value of the quanto adjustment is also known as the covariance:

这个如何定价?双币合约调整的理论值公式也称为协方差:

Covariance(ETHUSD, BTCUSD) = correlation(BTCUSD, ETHUSD) * volatility(BTCUSD) * volatility(ETHUSD)

Instantaneous Bankruptcy Risk

即时破产风险

Quanto perp swaps actually subject traders to instantaneous and unpredictable bankruptcy risk. Suppose a trader shorts 1 ETH @ 200 while BTC/USD is 10,000 and believes his liquidation price is 300. If ETH/USD goes to 250 and BTC/USD goes up to 12,500 at the same time, he will find that he is already liquidated because the size of his position is exploding with the BTC price itself.

Quanto 永久掉期实际上使交易员面临瞬时和不可预测的破产风险。假设一个交易者在200卖空1 ETH,而BTC / USD是10,000,并认为他的清算价格是300。如果ETH / USD升至250,而BTC / USD同时升至12,500,他会发现他的资产已经被清算了。因为他的头寸规模随着BTC价格本身而爆炸。

Traders could use quantos to take a view on the covariance. If they believe that correlation will be muted over the next few days and markets will be quiet in general, they may want to short quanto to receive funding. Conversely, if they believe that both BTC and ETH will rally together very quickly, they may want to long quanto and be happy paying quanto adjustment.

交易者可以使用双币合约来查看协方差。

如果他们认为未来几天相关性将被减弱,而市场总体上将保持平静,则他们可能希望做空做空以获得资金。相反,如果他们认为BTC和ETH会很快反弹,那么他们可能希望做多量化交易并乐于支付双币合约头寸上的调整。

Takeaways

结论

Quanto derivatives are not new products in financial markets but are likely to be new to most cryptocurrency traders. BitMEX has allowed the everyday trader easy exposure to new assets by offering quanto perpetual swap markets but also forces investors to have a view on the future movements of ETH and XRP and the covariance between each asset and the underlying BTC.

Quanto双币衍生品不是金融市场上的新产品,然而但对于大多数加密货币交易者而言可能是新产品。通过提供双币永久掉期市场,BitMEX使日常交易者可以轻松接触新资产以及金融合同,而且这也直接迫使投资者对ETH和XRP的未来走势以及每种资产与底层BTC之间的协方差必须持有一种交易看法。

Why are quantos valid predictors for FX returns?

为什么Quantos双币合约是外汇策略收益的有效预测指标?

“Investors’ expectations about currency returns can be inferred directly from the prices of…quanto contracts.”

”投资者对货币收益的期望可以直接从……对双币期权合约的价格中推断出来。”

“Consider, for example, a quanto contract whose payoff equals the level of the S&P 500 index at time T, denominated in euros. The value of such a contract is sensitive to the correlation between the S&P 500 index and the dollar/euro exchange rate. If the euro is strong relative to the dollar at times when the index is high, and weak when the index is low, then this quanto contract is more valuable than a conventional, dollar-denominated, claim on the index. We show that the relationship between (currency i) quanto and conventional forward prices on the S&P 500 index reveals the risk-neutral covariance between currency i and the index. Quantos therefore allow us to determine which currencies are risky,in that they tend to depreciate in bad times, i.e., when the stock market declines, and which are hedges. It is possible, of course, that a currency is risky at one point in time and a hedge at another.”

“例如,考虑一份双币合同,其收益等于时间T的标准普尔500指数水平,以欧元为单位。此类双币合约的价值对标准普尔500指数与美元/欧元汇率之间的相关性敏感。如果欧元在指数高时相对于美元坚挺,而在指数低时相对弱于美元,则该量化合约比以美元计价的常规传统指数更具价值。在标准普尔500指数中,(货币i)定量和传统远期价格之间的关系揭示了货币i与指数之间的风险中性协方差。 因此,Quantos允许我们确定哪些货币具有风险,因为它们往往在困难时期(即股市下跌时)贬值以及哪些是对冲货币。当然,一种货币可能在某个时间点具有风险,而在另一时间则可以对冲。”

“The quanto theory decomposes currency forecasts into a component based on interest-rate differentials and a risk-based component inferred from quanto prices…Intuitively, one expects that a currency that is (currently) risky should, as compensation, have higher expected appreciation than predicted by the uncovered interest rate parity, and that hedge currencies should have lower expected appreciation. Our framework formalizes this intuition. It also allows us to distinguish between variation in risk premia across currencies and variation over time: according to the theory, the relative importance of the two should be revealed by the behavior of quanto prices.”

“双币理论将货币预测分解为基于利率差异的成分和从双币价格推断出的基于风险的成分。直觉上,人们期望(当前)有风险的货币作为补偿应具有比预期更高的预期升值。由未发现的利率平价预测,对冲货币应具有较低的预期升值。 我们的框架将这种直觉形式化。 它还使我们能够区分货币风险溢价的变化与时间变化的变化:根据理论,两者之间的相对重要性应该通过双币合同的价格的行为来揭示。”

“Investor concerns about peso events [extreme values of stochastic discount factors or fear of massive depreciation] should be reflected in the forward-looking asset prices that we exploit, and thus our quanto predictor variable should forecast high appreciation for currencies vulnerable to peso events, even if no such events turn out to happen in sample.”

“投资者对比索事件的担忧(随机贴现因子的极值或担心大幅贬值)应反映在我们利用的前瞻性资产价格中,因此,我们的量化预测变量应预测易受比索事件影响的货币的高升值, 即使样本中没有发现此类事件。”

“Our quanto predictor …does not require that one takes the perspective of a risk-neutral investor [and] possesses the three appealing properties…

1. forecasts are determined by asset prices alone rather than on infrequently updated and imperfectly measured macroeconomic data…

2. the forecast has no free parameters; with no coefficients to be estimated…perfectly suited to out-of-sample forecasting…

3. the forecast has a straightforward interpretation.”

“我们的双币预测指标不需要一个从风险中立的投资者的角度出发,并且拥有三个吸引人的特性:

1.预测仅由资产价格决定,而不是由不经常更新和不完善的宏观经济数据决定。

2.预测没有自由参数; 没有要估计的系数...完全适合样本外预测...

3.预测具有直接的解释。”

What is the empirical evidence?

有什么经验证据以支持以上结论?

“We obtained forward prices and quanto forward prices on the S&P 500, together with domestic and foreign interest rates, from Markit; the maturity in each case is 24 months. The data is monthly and runs from December 2009 to November 2014 for the Australian dollar (AUD), Canadian dollar (CAD), Swiss franc (CHF), Danish krone (DKK), Euro (EUR), British pound (GBP), Japanese yen (JPY), Korean won (KRW), Norwegian krone (NOK), Polish zloty (PLN), and Swedish krona (SEK).”

“我们从Markit获得了S&P 500的远期价格和量化远期价格以及国内外利率。每种情况下的到期日均为24个月。数据为每月数据,运行时间为2009年12月至2014年11月,其中包括澳元(AUD),加元(CAD),瑞士法郎(CHF),丹麦克朗(DKK),欧元(EUR),英镑(GBP),日元 日元(JPY),韩元(KRW),挪威克朗(NOK),波兰兹罗提(PLN)和瑞典克朗(SEK)。”

“We test our approach by running panel currency-forecasting regressions, and find that the quanto predictor variable is strongly significant in both statistical and economic terms. We also show that the quanto predictor variable – equivalently, risk-neutral covariance – substantially outperforms lagged realized covariance as a forecaster of exchange rates; and that it is a strongly significant predictor of future realized covariance.”

“我们通过运行面板货币预测回归来测试我们的方法,发现量化预测变量在统计和经济方面都具有显着意义。我们还表明,双币预测变量(等效地,风险中性协方差)在预测汇率方面远胜于落后的已实现协方差。而且它是未来实现的协方差的重要预测指标。”

“We [test]…the out-of-sample predictive performance of the quanto variable…Since our data span a relatively short period (from 2009 to 2014) over which the dollar strengthened against almost all the other currencies in our dataset, we focus on forecasting differential returns on currencies. This allows us to isolate the cross-sectional forecasting power of the quanto variable in a dollar-neutral way.”

“我们[测试]…量化变量的样本外预测性能……由于我们的数据跨越相对较短的时期(从2009年到2014年),在这段时期内美元兑我们数据集中的几乎所有其他货币都升值了, 预测货币的差异收益。这使我们能够以美元无关的方式隔离Quanto双币变量的横截面预测能力。”

“When the coefficient on the quanto predictor is fixed at the level implied by the theory, we end up with a forecast of currency appreciation that has no free parameters, and which is therefore…perfectly suited for out-of- sample forecasting…We compute mean squared error and mean absolute error for the forecasts made by the quanto theory and by three competitor models: uncovered interest parity, which predicts currency appreciation through the interest-rate differential; purchasing power parity… and a random-walk forecast. The quanto theory outperforms all three competitors on both metrics.”

“当双币合约预测变量的系数固定在理论所暗示的水平时,我们最终得到的货币升值预测没有自由参数,因此Quanto非常适合样本外预测,当我们计算双币期权价格理论和三种竞争者模型所作的预测的均方误差和均值绝对误差:未发现的利率平价,通过利率差异预测货币升值;购买力平价…和随机游走预测。双币理论在这两个指标上均胜过所有三个竞争对手。”

推荐阅读

-

虚拟币平台差价买卖?虚拟币平台差价买卖违法吗

1970-01-01

Intuitively, one expects that a currency that is (currently)...

-

国内虚拟货币挖矿停止(会产生重大影响吗?)

1970-01-01

Intuitively, one expects that a currency that is (currently)...

-

浙江整治虚拟货币挖矿企业(浙江华冶矿建集团有限公司介绍)

1970-01-01

Intuitively, one expects that a currency that is (currently)...

-

虚拟币用什么平台直播好 虚拟币用什么平台直播好呢

1970-01-01

Intuitively, one expects that a currency that is (currently)...

-

关于政治虚拟货币的问题(欧美国家为什么没有禁止?)

1970-01-01

Intuitively, one expects that a currency that is (currently)...

-

虚拟游戏币充值平台?虚拟游戏币充值平台有哪些

1970-01-01

Intuitively, one expects that a currency that is (currently)...